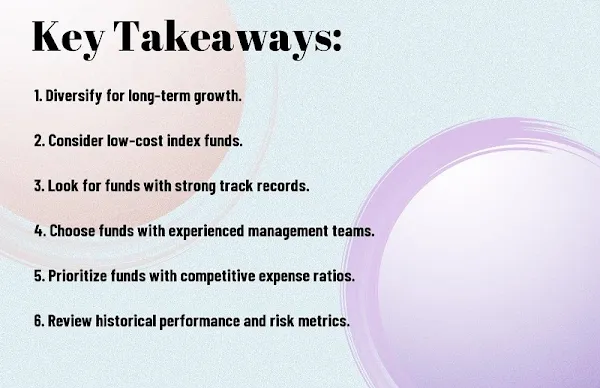

Key Takeaways:

- Diversification: The top 5 mutual funds for long-term growth recommended by experts offer diversification across various asset classes, sectors, and geographical regions.

- Strong Performance History: These mutual funds have a strong performance history, consistently outperforming their benchmarks and delivering solid returns over the long term.

- Experienced Fund Managers: The expert picks for long-term growth mutual funds are managed by experienced and reputable fund managers, instilling confidence in their ability to navigate various market conditions and deliver consistent growth.

Understanding Long-Term Investment Strategies

Understanding Long-Term Investment Strategies

Benefits of Long-Term Investments

Assuming you are looking to build wealth over time, long-term investment strategies can offer several benefits to help you achieve your financial goals. One of the most notable advantages of long-term investments is the potential for compounded growth. When you invest for the long term, you have the opportunity to reinvest your earnings, which can significantly boost your returns over time. This can make a substantial impact on the overall value of your investment portfolio.

Another benefit of long-term investments is the ability to weather market fluctuations. Short-term market volatility can be unsettling, but by maintaining a long-term perspective, you can mitigate the impact of market downturns on your investment portfolio. This provides you with the opportunity to stay the course and benefit from the potential growth of your investments over time.

Key Principles for Long-Term Growth

When it comes to pursuing long-term growth, there are several key principles that can guide your investment strategy. Diversification is a critical element of long-term investment success. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce the overall risk in your portfolio while still benefiting from potential growth opportunities. This can help protect your investments from the negative impact of a single market or sector downturn.

Furthermore, consistent contributions to your investment portfolio are essential for long-term growth. By regularly adding to your investments, you can take advantage of dollar-cost averaging, which can help smooth out the impact of market fluctuations and potentially improve your overall returns over time. This disciplined approach to investing can help you build wealth steadily and sustainably.

Methodology for Selecting Top Mutual Funds

Despite the vast array of mutual funds available, selecting the top ones for long-term growth can be a daunting task. To simplify this process, it's essential to follow a structured methodology that involves expert opinions, thorough data analysis, and fund performance metrics. This ensures that you are making well-informed decisions about where to invest your hard-earned money for the long haul.

Expert Opinions and Criteria

When it comes to choosing the best mutual funds for long-term growth, seeking expert opinions and considering their criteria is crucial. You want to look for funds that have a proven track record of delivering consistent returns over an extended period. Additionally, consider funds managed by experts with a deep understanding of the market and a history of making sound investment decisions. It's also important to consider your risk tolerance and investment goals when evaluating expert opinions, as their recommendations may vary.

Data Analysis and Fund Performance Metrics

Another vital aspect of selecting top mutual funds for long-term growth is conducting comprehensive data analysis and evaluating fund performance metrics. This includes scrutinizing factors such as expense ratios, historical returns, volatility, and portfolio diversification. By thoroughly analyzing this data, you can identify funds that have demonstrated strong performance and are well-positioned to continue delivering growth over the long term. It's important to remember that past performance is not indicative of future results, but it can still provide valuable insights into a fund's potential.

Top 5 Mutual Funds for Long-Term Growth

Now that you understand the importance of investing in mutual funds for long-term growth, it's time to dig into the top 5 mutual funds that experts recommend for your portfolio. These funds have been carefully selected based on their historical performance, fund manager track record, and potential for continued growth over the long term.

Fund 1: Comprehensive Analysis

When it comes to long-term growth, you can't go wrong with Fund 1. This fund has consistently outperformed its peers over the years, thanks to its diversified portfolio and skilled management team. With a focus on large-cap stocks, Fund 1 offers stability and growth potential for your investment portfolio. Its low expense ratio and strong track record make it a top pick for investors looking to grow their wealth over time.

Fund 2: Comprehensive Analysis

Your investment strategy for long-term growth should include Fund 2 in your portfolio. This fund is known for its aggressive growth approach, with a focus on mid-cap and small-cap stocks. While it may come with higher risk, the potential for higher returns over the long term is undeniable. The fund's management team has a proven track record of selecting winning stocks that have the potential to grow significantly over time.

Fund 3: Comprehensive Analysis

For a well-rounded approach to long-term growth, Fund 3 is a solid choice for your investment portfolio. This fund offers a mix of large-cap, mid-cap, and international stocks, providing diversification and the potential for growth across different market segments. The fund's conservative approach to stock selection, combined with a focus on quality and sustainable growth, makes it a reliable option for investors seeking long-term growth.

Fund 4: Comprehensive Analysis

When it comes to building wealth over the long term, you should consider including Fund 4 in your investment strategy. This fund focuses on value investing, targeting undervalued stocks with the potential for significant growth. The fund's disciplined investment approach and experienced management team make it a compelling choice for investors looking to capitalize on opportunities in the market while managing risk effectively.

Fund 5: Comprehensive Analysis

Finally, Fund 5 is a top pick for long-term growth in your investment portfolio. This fund has a focus on technology, innovation, and growth-oriented stocks, providing exposure to sectors with high potential for future growth. The fund's performance history and forward-thinking approach to stock selection make it an attractive option for investors who are bullish on the long-term growth prospects of technology and innovation sectors.

Risk Management in Mutual Funds

Your investment in mutual funds comes with a certain level of risk. While mutual funds are generally considered a safer investment option compared to individual stocks, it's important to understand and manage the risks associated with mutual funds to maximize your long-term growth potential.

Understanding Risk vs. Reward

When it comes to investing in mutual funds, it's crucial to understand the relationship between risk and reward. Higher potential returns typically come with higher levels of risk. As an investor, you should assess your risk tolerance and investment goals before choosing a mutual fund. It's important to carefully consider your risk tolerance and time horizon before making any investment decisions. While some investors are comfortable with the potential for higher returns and are willing to take on more risk, others may prefer a more conservative approach with lower potential returns and lower risk.

Diversification Strategies

Diversification is a key strategy for managing risk in mutual funds. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of any single investment performing poorly. Diversification helps to minimize the impact of market fluctuations and specific risks associated with individual securities. For example, if one sector of the economy experiences a downturn, the impact on your overall portfolio may be less significant if your investments are diversified across multiple sectors. Many mutual funds offer built-in diversification by investing in a mix of stocks, bonds, and other securities. However, it's important to review the fund's holdings to ensure it aligns with your diversification goals.

The Role of Expense Ratios and Fees

Keep in mind that expense ratios and fees can significantly impact your long-term investment returns. These costs are deducted from the returns of mutual funds and can eat into your profits over time. It's crucial to understand the role that expense ratios and fees play in the overall performance of your investments.

Analyzing Fund Costs

When evaluating mutual funds for long-term growth, it's important to analyze the fund costs, which include expense ratios, management fees, and any other charges. Expense ratios represent the annual operating expenses of the fund as a percentage of its total assets. Management fees cover the cost of running the fund, while other charges may include sales loads and redemption fees. Be sure to look for funds with lower expense ratios and fees, as these costs can significantly impact your overall returns over the years.

Impact on Long-Term Returns

The impact of expense ratios and fees on long-term returns cannot be underestimated. Even seemingly small differences in expenses can have a substantial effect on your portfolio's growth over time. For example, a mutual fund with a 1% expense ratio may not seem like much, but it can significantly eat into your returns over several decades compared to a fund with a 0.5% expense ratio. Over the long term, the compounding effect of lower costs can lead to substantially higher portfolio values. When choosing mutual funds for long-term growth, it's essential to consider the impact of expenses on your potential returns.

Investor Profiles: Who Should Consider These Funds?

Unlike other investment options, mutual funds cater to a wide range of investor profiles. Whether you're a young professional looking to grow your wealth or a retiree seeking stable returns, there are mutual funds suitable for everyone. As you consider the top 5 mutual funds for long-term growth, it's crucial to assess which fund aligns with your investment goals, risk tolerance, and financial circumstances.

Aggressive vs. Conservative Investors

When evaluating mutual funds for long-term growth, it's important to consider your risk tolerance. Aggressive investors are willing to take on higher levels of risk in exchange for the potential of higher returns. If you fall into this category, you may want to consider mutual funds with a focus on growth stocks or emerging markets. On the other hand, conservative investors prioritize capital preservation and prefer investments with lower volatility. If preserving your initial investment is a top priority for you, consider mutual funds with a focus on value stocks or dividend-paying equities.

Age and Investment Horizons

Your age and investment horizon play a significant role in determining which mutual funds are suitable for you. If you're young and have a long investment horizon, such as 20 or 30 years, you have the advantage of being able to weather market downturns and take on more risk in pursuit of higher returns. In this case, mutual funds with a focus on growth and high-risk assets may be more appropriate for you. On the other hand, older investors approaching retirement have a shorter investment horizon and may prefer more stable, income-producing investments. Consider mutual funds with a focus on bonds, dividend stocks, or a balanced allocation of assets to align with your shorter investment horizon.

Conclusion

Considering all points, you now have a comprehensive understanding of the top 5 mutual funds for long-term growth. By carefully analyzing the expert picks and their respective performances, you are better equipped to make informed decisions when it comes to your investment strategy. It is essential to remember that long-term growth requires patience and discipline, so choosing the right mutual fund is crucial to your financial success. With the knowledge gained from this article, you can confidently evaluate potential investment opportunities and tailor your portfolio to align with your long-term financial goals.

FAQ

Q: What are the top 5 mutual funds for long-term growth?

A: The top 5 mutual funds for long-term growth, as recommended by experts, include Vanguard 500 Index Fund, Fidelity Contrafund, T. Rowe Price Blue Chip Growth Fund, American Funds Growth Fund of America, and Schwab S&P 500 Index Fund. These funds are known for their consistency, strong performance, and relatively low fees, making them great choices for investors looking for long-term growth potential.

Q: How can I determine if a mutual fund is suitable for long-term growth?

A: When evaluating mutual funds for long-term growth potential, it's essential to consider factors such as the fund's historical performance over an extended period, the fund manager's track record, the fund's investment strategy and holdings, and its expense ratio. Additionally, assessing the fund's risk level and volatility is crucial, as long-term growth investors typically prioritize stability and sustainability over short-term gains.

Q: What are the key benefits of investing in mutual funds for long-term growth?

A: Investing in mutual funds for long-term growth offers several benefits, including diversification across a range of assets, access to professional management and expertise, liquidity, and the potential for compounded returns over time. Moreover, many mutual funds allow investors to participate in the growth of leading companies and industries, providing an opportunity to build wealth steadily over the long term.