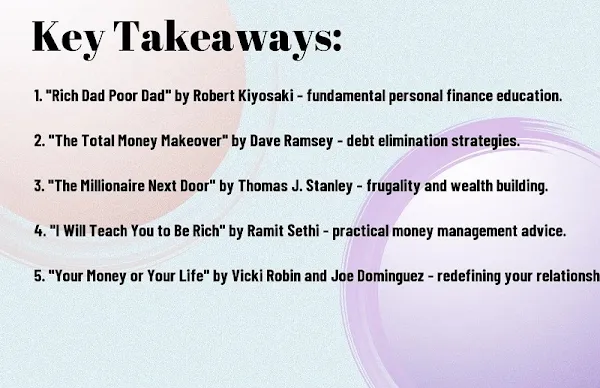

Key Takeaways:

- Diverse Perspectives: The top 5 personal finance books offer a range of perspectives on wealth building, from practical budgeting advice to mindset shifts and investment strategies.

- Holistic Approach: These must-read books emphasize the importance of addressing not just financial habits, but also personal values, goals, and behaviors to achieve true wealth and financial security.

- Actionable Strategies: Readers will find practical, actionable strategies and tips for managing money, investing, and building a solid financial foundation for the future.

Book One: "The Total Money Makeover" by Dave Ramsey

Any personal finance enthusiast worth their salt has heard of "The Total Money Makeover" by Dave Ramsey. With a no-nonsense approach to managing your finances, Ramsey's book provides practical steps for taking control of your money and building wealth.

Mastering the Basics of Budgeting

When it comes to managing your finances, budgeting is the foundation of it all. Ramsey emphasizes the importance of creating a monthly budget and sticking to it. By tracking your expenses and income, you can gain a clear understanding of where your money is going and identify areas where you can cut back. By mastering the basics of budgeting, you'll be able to take control of your spending and make informed financial decisions.

The Debt Snowball Method Explained

Ramsey is known for his debt snowball method, which involves paying off your debts from smallest to largest, regardless of interest rates. While it may seem counterintuitive, the psychological impact of paying off smaller debts first can give you the momentum and motivation you need to tackle larger debts. By following this method, you can gain a sense of accomplishment and momentum as you work towards becoming debt-free.

Building Your Emergency Fund and Wealth Building

In "The Total Money Makeover," Ramsey stresses the importance of building an emergency fund to cushion the impact of unexpected expenses. This provides a sense of security and prevents you from turning to debt when life throws a curveball. Additionally, Ramsey outlines the steps to wealth building, including investing for the long term and staying disciplined in your financial journey. By prioritizing your emergency fund and long-term wealth building, you can safeguard your finances and set yourself up for future financial success.

Book Two: "Rich Dad Poor Dad" by Robert T. Kiyosaki

Unlike traditional personal finance books, "Rich Dad Poor Dad" by Robert T. Kiyosaki provides a unique perspective on building wealth and achieving financial independence. Through the author's personal experiences and lessons learned from his own "rich dad" and "poor dad," this book challenges traditional mindsets about money and offers valuable insights into the power of investment and passive income.

Challenging Traditional Mindsets about Money

In "Rich Dad Poor Dad," Kiyosaki challenges the traditional view of working for money and instead, encourages you to make money work for you. The book challenges you to think about money as a tool for building wealth rather than simply a means of survival. Kiyosaki's teachings highlight the importance of financial education and the impact of mindset on your ability to achieve financial success. This book will shift your perspective on money and empower you to take control of your financial future.

The Power of Investment and Passive Income

Kiyosaki emphasizes the power of investment and passive income as key components of building wealth. He introduces you to the concepts of assets versus liabilities and the importance of putting your money to work for you. By understanding the principles of investing and generating passive income, you can create a pathway to financial freedom. "Rich Dad Poor Dad" will inspire you to take calculated risks and to seek opportunities for generating long-term wealth through investments and passive income streams.

Book Three: "Your Money or Your Life" by Vicki Robin and Joe Dominguez

To truly understand the relationship between your money and your life, "Your Money or Your Life" is an essential read. This groundbreaking book challenges the traditional concept of wealth and encourages you to align your finances with your values, ultimately leading to financial independence and early retirement.

Aligning Your Finances with Your Values

"Your Money or Your Life" emphasizes the importance of aligning your financial choices with your personal values. By understanding the true cost of each expenditure and assessing whether it brings fulfillment, you can make more conscious decisions about how you spend and save. This book provides a practical framework for evaluating your relationship with money and aligning it with what truly matters to you. By implementing these principles, you can gain a stronger sense of control over your finances and live a more fulfilling life.

Achieving Financial Independence and Retiring Early

One of the key concepts of "Your Money or Your Life" is the idea of achieving financial independence and retiring early (FIRE). This approach involves saving and investing aggressively, making intentional lifestyle choices, and prioritizing financial freedom. The book outlines a step-by-step plan to help you achieve FIRE, allowing you to have greater flexibility and autonomy in how you live your life. By following the principles outlined in "Your Money or Your Life," you can take steps towards breaking free from the traditional constraints of the 9-5 workday and gain the freedom to pursue your passions.

Book Four: "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

Keep reading to find out why "The Millionaire Next Door" is a must-read for anyone looking to build wealth and achieve financial independence.

Debunking Myths About Millionaires

Many people have preconceived notions about what it means to be a millionaire. In this book, Stanley and Danko challenge these misconceptions and provide insights into the true lifestyles and habits of millionaires. One of the most important revelations is that the majority of millionaires are not flashy spenders living in mansions and driving luxury cars. In fact, you may be surprised to learn that many millionaires live in modest homes and drive older cars. By debunking these myths, the authors help you shift your focus from outward displays of wealth to the real indicators of financial success.

The Seven Common Traits of Successful Wealth Accumulators

Understanding the common traits of successful wealth accumulators is crucial for anyone looking to emulate their success. The book outlines seven key characteristics that are prevalent among millionaires, including frugality, discipline, and a long-term mindset. By adopting these traits into your own financial habits, you can set yourself on the path to accumulating wealth and achieving financial freedom. This section of the book provides invaluable insights that can help you rethink your approach to money management and set you on the path to success.

Book Five: "Think and Grow Rich" by Napoleon Hill

Not just a personal finance book, "Think and Grow Rich" by Napoleon Hill is a timeless classic that delves into the psychology of success and prosperity. Hill's principles are as relevant today as they were when the book was first published in 1937. By studying the lives of successful individuals, Hill identified the common traits and beliefs that led to their wealth and achievement.

The Role of Personal Beliefs in Wealth Creation

In "Think and Grow Rich," Napoleon Hill emphasizes the role of personal beliefs in wealth creation. He argues that your thoughts and beliefs have a profound impact on your ability to accumulate wealth. Your beliefs can either propel you toward success or hold you back from achieving your financial goals. Hill's teachings emphasize the importance of cultivating a positive mindset and removing self-limiting beliefs that may hinder your financial success. By changing your beliefs and mindset, you can pave the way for greater wealth and abundance in your life.

Thirteen Steps to Riches: The Philosophy of Success

One of the key elements of "Think and Grow Rich" is Hill's "Thirteen Steps to Riches." These steps outline a practical philosophy of success that focuses on the power of desire, faith, and persistence in achieving your financial goals. According to Hill, these steps are essential for transforming your dreams into reality and achieving lasting wealth. By following these principles, you can develop the mindset and behavior necessary to attract prosperity and abundance into your life. The book provides a roadmap to success, guiding you through the essential principles and actions required to build wealth and achieve your financial aspirations.

Implementing the Lessons

After reading the top 5 personal finance books, you're probably feeling inspired and motivated to take control of your financial future. But now comes the hard part - implementing the valuable lessons and strategies you've learned. It's one thing to absorb the information, but it's another to put it into action. Here's how you can take the guidance from these books and make it work for your own financial situation.

Key Takeaways and Actionable Advice

As you reflect on the key takeaways from each book, consider how you can apply them to your own financial journey. Whether it's setting up a budget, creating an emergency fund, or investing in the stock market, identify the specific steps you can take to put these lessons into practice. Take actionable advice such as automating your savings or setting up regular investment contributions to ensure you're consistently working towards your financial goals.

Integrating Strategies into Daily Financial Practices

Integrating the strategies you've learned into your daily financial practices is crucial for long-term success. This means adopting new habits, such as tracking your expenses, living below your means, and making conscious spending decisions. It's important to be mindful of your financial decisions and how they align with the principles outlined in the books you've read. By integrating these strategies into your daily routine, you'll be able to make significant progress towards building wealth and achieving financial stability.

Keep in mind that implementing the lessons from these personal finance books may require time, dedication, and discipline. While the journey to financial success may not always be easy, the rewards of taking control of your financial future are immeasurable. Remember that small changes can lead to significant outcomes, and the knowledge you've gained from these books has equipped you with the tools to make it happen.

Take the time to develop a plan and set achievable goals based on the principles you've learned from these books. It's imperative to remain patient and consistent in your efforts, as building wealth is a gradual process that requires steadfast commitment.Conclusion: The Top 5 Personal Finance Books to Read - Must-Reads for Building Wealth

Now that you have explored the top 5 personal finance books to read for building wealth, you are equipped with invaluable knowledge and insights to take control of your financial future. Whether you are looking to learn the fundamentals of personal finance, invest in stocks, real estate, or simply gain a deeper understanding of money management, these books offer a wealth of wisdom and practical advice. By incorporating the principles and strategies outlined in these must-reads into your financial planning, you can set yourself on the path towards financial success and stability.

Remember, the journey to financial freedom is a lifelong pursuit, and continuously educating yourself is essential to achieving your financial goals. Embrace the wisdom found in these books and apply it to your own financial journey. You have the power to take control of your financial destiny and build the wealth and security you desire. Keep learning, stay disciplined, and take action towards your financial aspirations. Your future self will thank you for the investment you make in your financial education and planning today.

FAQ

Q: What are the top 5 personal finance books to read for building wealth?

A: The top 5 personal finance books for building wealth are "Rich Dad Poor Dad" by Robert Kiyosaki, "The Total Money Makeover" by Dave Ramsey, "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko, "Your Money or Your Life" by Vicki Robin and Joe Dominguez, and "I Will Teach You to Be Rich" by Ramit Sethi.

Q: Why is "Rich Dad Poor Dad" considered a must-read for building wealth?

A: "Rich Dad Poor Dad" is considered a must-read for building wealth because it teaches valuable financial lessons through the contrasting experiences of the author's biological father (the poor dad) and the father of his childhood best friend (the rich dad). The book emphasizes the importance of financial education, investing, and passive income to achieve financial freedom.

Q: What makes "The Total Money Makeover" a recommended book for personal finance?

A: "The Total Money Makeover" is a recommended book for personal finance because it provides a practical, step-by-step approach to getting out of debt, saving, and investing for the future. Dave Ramsey's straightforward advice and motivational strategies have helped countless individuals and families achieve financial stability and build wealth.