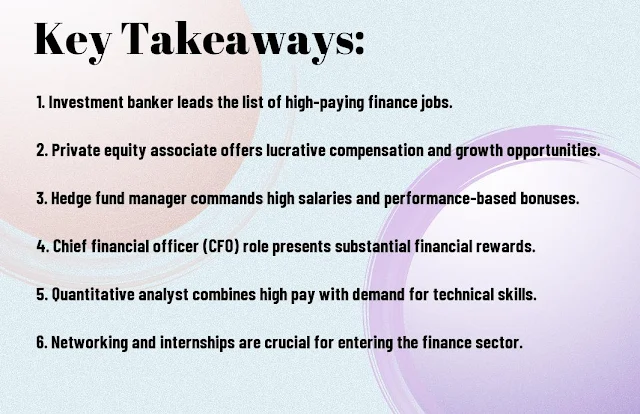

Are you ready to take your career in finance to the next level? In this informative blog post, we will be discussing the top 5 high paying jobs in finance and providing you with insider tips and strategies for landing your dream career in this competitive field. Whether you're a recent graduate looking to get your foot in the door or a seasoned professional seeking new opportunities, this post will give you the inside scoop on the most lucrative and rewarding finance jobs available. From investment banking to hedge fund management, we'll cover the most coveted positions in the industry and equip you with the knowledge you need to succeed. So, sit back, grab your notebook, and get ready to take your finance career to the next level!

Investment Banking

The world of investment banking is fast-paced, challenging, and highly rewarding. If you're looking for a career in finance that offers high earning potential and the opportunity to work on high-profile deals, investment banking may be the right fit for you.

Understanding Investment Banking Roles

When it comes to investment banking, there are several key roles that you can pursue. These roles include investment banking analyst, associate, vice president, and managing director. As an analyst, you will be responsible for performing financial modeling, creating pitch books, and conducting industry research. As you progress in your career, you may take on more client-facing responsibilities and eventually lead deal teams as a managing director. Each role comes with its own set of challenges and opportunities, and it's important to understand the expectations and demands of each position as you consider your career path in investment banking.

Strategies for Breaking into Investment Banking

Breaking into investment banking can be highly competitive, but with the right strategies, you can increase your chances of landing a coveted position. One of the most important steps you can take is to ensure that you have a strong academic background, preferably with a degree in finance, economics, or a related field. Additionally, gaining relevant work experience through internships or entry-level positions can give you a competitive edge. Networking with professionals in the industry and showcasing your passion for finance through your resume and cover letter can also help you stand out from the crowd. Keep in mind that the interview process for investment banking positions can be rigorous, so it's essential to prepare thoroughly and demonstrate your knowledge of the industry and your problem-solving abilities.

Hedge Funds

Any financial professional who desires a challenging and lucrative career in finance should consider pursuing a role in hedge funds. Hedge funds are investment funds that utilize various strategies to maximize returns for their investors. As a hedge fund professional, you can expect to work in a fast-paced and intellectually stimulating environment where your decisions can have a significant impact on the bottom line.

The Role of Hedge Fund Managers

As a hedge fund manager, your primary responsibility is to oversee the investment strategies and portfolio management of the fund. You will be tasked with making critical decisions regarding asset allocation, risk management, and executing trades. Your ability to navigate complex financial markets and identify profitable opportunities will be crucial to the success of the fund. Furthermore, you will need to effectively communicate the fund's performance and investment strategies to current and potential investors.

Essential Skills for a Successful Career in Hedge Funds

To excel in the world of hedge funds, you must possess a unique set of skills. Strong analytical and critical thinking abilities are essential, as you will need to evaluate complex financial data and make informed investment decisions. Additionally, you must possess excellent communication and interpersonal skills to effectively interact with clients, colleagues, and other industry professionals. Having a deep understanding of financial markets and the ability to adapt to changing market conditions is also crucial for success in hedge funds.

It is important to note that working in hedge funds can be extremely demanding, with long hours and high-pressure situations being the norm. The potential for substantial financial rewards, however, makes the industry highly appealing to ambitious professionals like yourself. By honing your analytical skills and staying abreast of market trends, you can position yourself for a successful career in hedge funds.

Private Equity

Unlike other finance careers, private equity offers the opportunity to work directly with businesses to make strategic investments and foster growth. If you have a passion for identifying investment opportunities, negotiating deals, and working closely with company management, a career in private equity may be the perfect fit for you.

Overview of Private Equity Positions

Private equity firms typically offer positions at various levels, including Analyst, Associate, Vice President, and Partner. As an Analyst, you will be responsible for conducting due diligence on potential investment opportunities, preparing financial models, and supporting the deal team throughout the transaction process. Associates take on a more senior role, leading deal teams and driving the investment process. Vice Presidents focus on sourcing new investment opportunities and managing portfolio companies, while Partners are responsible for making investment decisions and driving the overall strategy of the firm.

Tips for Pursuing a Career in Private Equity

If you are considering a career in private equity, it's important to gain relevant experience early on. Look for internships or entry-level positions at investment banks, consulting firms, or other financial institutions to build a solid foundation. Pursuing a MBA can also enhance your credentials and open doors to top private equity firms. Networking is crucial, so make sure to attend industry events, join professional organizations, and build relationships with professionals in the field. Any opportunity to showcase your analytical skills and passion for investments will set you apart from other candidates.

Corporate Finance Careers

After gaining some experience in the finance industry, you might find yourself drawn to corporate finance careers. These roles are often high-paying and can offer you the opportunity to work for some of the world's largest and most prestigious companies. Here's what you need to know about pursuing a career in corporate finance.

High-Level Corporate Finance Roles

If you're aiming for a high-level corporate finance role, you'll likely be seeking positions such as Chief Financial Officer (CFO), Financial Controller, Treasurer, or Director of Finance. These positions come with significant responsibility, and you'll be expected to provide strategic financial leadership, manage financial risks, and drive the company's overall financial performance. It's a challenging but rewarding path that can lead to substantial career growth and excellent financial rewards.

Pathways to Advancement in Corporate Finance

Advancing in corporate finance often involves a combination of experience, education, and professional development. Many professionals in corporate finance start their careers in entry-level analyst roles, gaining experience in areas such as financial planning, analysis, and reporting. From there, you can pursue advanced degrees, such as a Master of Business Administration (MBA) or other specialized certifications, to increase your chances of moving up the corporate finance ladder. Networking and building relationships with industry professionals can also be critical to your success in advancing your corporate finance career.

Financial Technology (FinTech)

For those interested in a high-paying career in finance, the world of Financial Technology (FinTech) offers a unique and exciting opportunity. With the rapid advancements in technology and a growing demand for innovation in financial services, FinTech has become a lucrative sector with a wide range of high-paying job opportunities. Whether you have a background in finance, technology, or both, there are ample opportunities for you to carve out a successful career in FinTech.

The Emergence of FinTech

The emergence of FinTech has revolutionized the financial industry, disrupting traditional banking and financial services with innovative technological solutions. The use of artificial intelligence, blockchain, and big data has transformed how financial transactions are conducted, creating new opportunities for efficiency and convenience. The rapid growth of FinTech has led to the creation of new job roles, such as data scientists, software developers, and cybersecurity experts, all of which offer competitive salaries and career prospects.

How to Secure a Position in the FinTech Revolution

To secure a position in the FinTech revolution, you need to stay abreast of the latest technological advancements and their impact on the financial industry. Familiarize yourself with programming languages, such as Python and Java, as well as data analysis tools like SQL and R. Additionally, gaining experience in financial modeling, risk management, and compliance will make you a valuable asset to FinTech companies. Networking within the FinTech community and leveraging online platforms to showcase your skills and expertise will also increase your chances of landing a high-paying job in this dynamic industry.

Conclusion

On the whole, pursuing a career in finance can be a lucrative and rewarding endeavor. By identifying the top high paying jobs in finance and understanding what it takes to land these positions, you are already on the right track to achieving your dream career. Remember to continuously strive for excellence, stay updated on industry trends, and network with professionals in the field. With dedication and perseverance, you can position yourself for success in the competitive world of finance.