Considering the current market conditions, high yield savings accounts have become a popular option for individuals looking to earn a better return on their savings. However, it's important to weigh the benefits and drawbacks of these accounts before making a decision on whether they are worth it for you.

Understanding High Yield Savings Accounts

Some people may have heard of high yield savings accounts but may not fully understand what they are and how they differ from traditional savings accounts.

Definition and Characteristics of High Yield Savings

High yield savings accounts are a type of savings account offered by banks and credit unions that generally offer a higher interest rate than traditional savings accounts. The "high yield" in the name refers to this higher interest rate, which allows your savings to grow at a faster rate than it would in a traditional savings account. These accounts typically have no monthly maintenance fees and may have a higher minimum balance requirement in order to earn the highest interest rate available.

How High Yield Savings Accounts Differ from Traditional Savings

One of the main differences between high yield savings accounts and traditional savings accounts is the interest rate. Traditional savings accounts often offer very low interest rates, which means your savings may not grow much over time. In contrast, high yield savings accounts offer much higher interest rates, allowing your money to work harder for you. Another key difference is that high yield savings accounts are often offered by online banks, which means you may not have access to physical branches. However, many people find the convenience of online banking to be well worth it, especially with the higher potential returns.

Evaluating the Benefits and Drawbacks

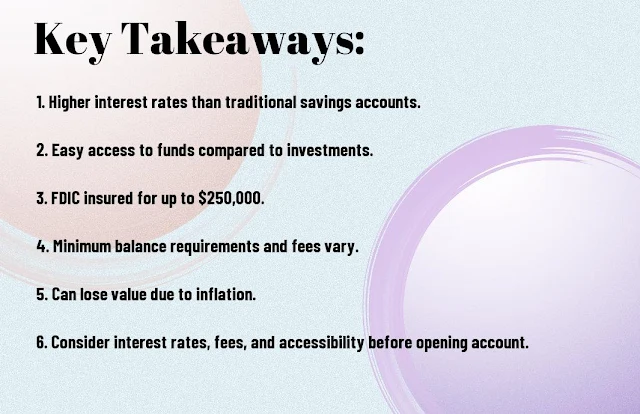

While high yield savings accounts offer the potential for higher interest rates, it's important to carefully consider both the benefits and drawbacks before deciding if they are worth it for you. Evaluating the advantages and disadvantages can help you make an informed decision about whether a high yield savings account is the right choice for your financial goals.

Assessing the Advantages of High Yield Savings Accounts

One of the main advantages of high yield savings accounts is the potential for higher interest rates. Unlike traditional savings accounts, high yield accounts offer rates that are significantly higher, allowing your savings to grow at a faster pace. Additionally, these accounts are typically FDIC insured, providing a level of security for your deposits up to the maximum limit. This can give you peace of mind knowing that your money is protected.

Recognizing the Potential Disadvantages and Limitations

On the other hand, it's important to recognize the potential drawbacks and limitations of high yield savings accounts. While the interest rates are higher compared to traditional accounts, they may still be lower than other investment options such as stocks or mutual funds. Additionally, some high yield accounts may have minimum balance requirements or limit the number of withdrawals you can make each month, which could impact your access to funds when needed.

Making an Informed Decision

For many people, saving money is a top priority. High yield savings accounts offer the opportunity to earn higher interest rates compared to traditional savings accounts. However, before you make a decision about whether or not to open a high yield savings account, it's important to consider a few factors.

Comparing High Yield Savings Accounts with Other Savings Tools

When considering opening a high yield savings account, it's important to compare it with other savings tools available to you. Here's a comparison of high yield savings accounts with other common savings tools:

| High Yield Savings Account | Traditional Savings Account |

| Earn higher interest rates | Earn lower interest rates |

| May have minimum balance requirements | May have lower minimum balance requirements |

| Often offered by online banks | Offered by traditional banks |

| Limited to 6 withdrawals per month | Limited withdrawals may apply |

Strategies for Maximizing Your Savings

When it comes to maximizing your savings with a high yield savings account, there are a few strategies you can employ to make the most of this financial tool. One strategy is to regularly contribute to your account to take full advantage of the compounding interest. Additionally, you can set up automatic transfers to ensure a portion of your income goes directly into the account, helping you grow your savings over time.

High Yield Savings Accounts - Are They Worth It?

Presently, High Yield Savings Accounts are definitely worth it if you are looking to earn a higher interest rate on your savings. They offer a competitive interest rate compared to traditional savings accounts, helping you grow your savings faster. Additionally, High Yield Savings Accounts are a safe and secure way to store your money, as they are typically FDIC insured. By taking advantage of a High Yield Savings Account, you can maximize the return on your savings without taking on unnecessary risk. So, if you want to make the most of your savings, a High Yield Savings Account can be a smart choice for you.